Market Outlook: China’s Concerning Macroeconomic State

Author: Yang Peng, Investment Analyst

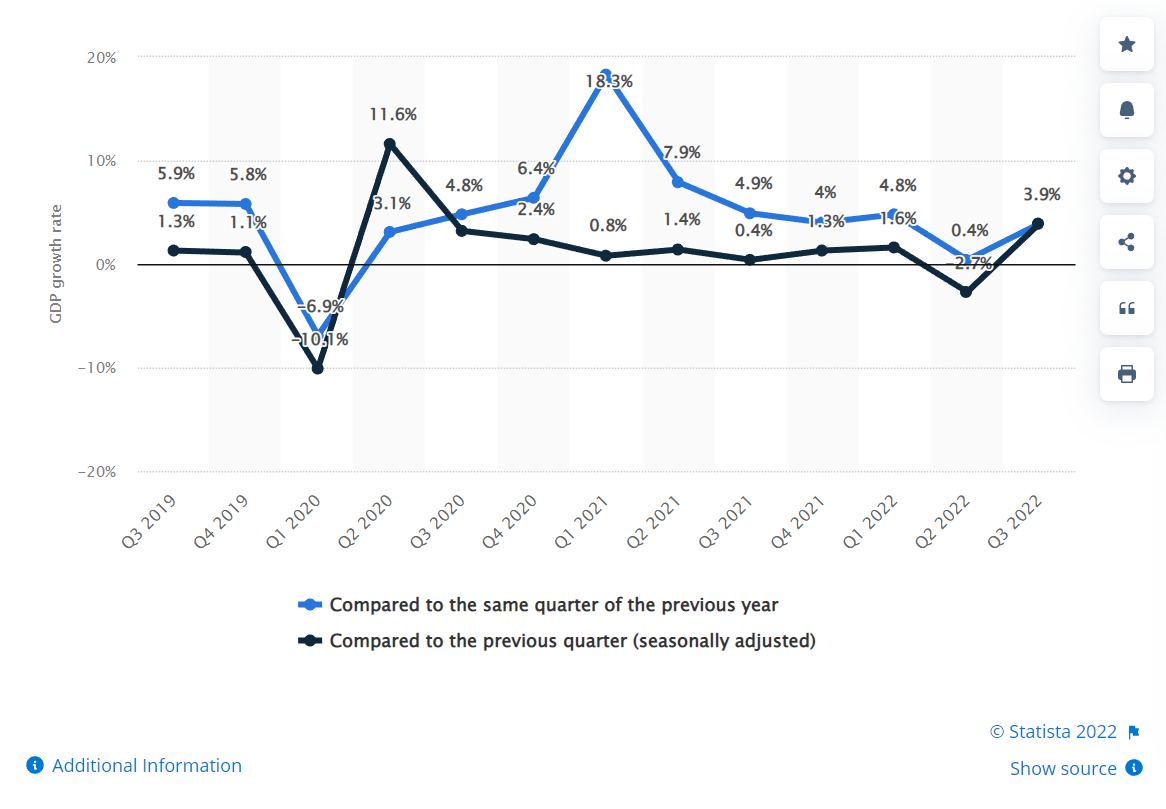

Recently, China released its key economic data which showed a 3.9% YoY growth in its Q3 GDP and a 6.3% YoY growth in its Industrial output 6.3%, both beating their expectation of 3.3% and 4.8%, respectively. However, consumer spending only grew 2.5% YoY, missing the expectation of 3%.

Quarterly gross domestic product (GDP) growth rate in China from 3rd quarter 2019 to 3rd quarter 2022 (Source: Statista)

Although the economic data may seem promising, there’s still a long list of challenges that China is facing:

- Housing crisis and mortgage boycott continue

- Increasing debt struggles domestically from massive and non-profitable infrastructure projects such as the high-speed railways

-Growing concerns over debt crisis from the one belt one road project

- Henan rural banks freezing deposits worsens the trust between people and local government

- Zero Covid policy continues at the cost of a slowing economy

- China’s shrinking workforce population and growing aging population

- Unemployment on the rise and large outflow of talents

- Foreign businesses moving their manufacturing to other countries

- Hong Kong losing its financial hub status due to Beijing’s stronger grip

These issues in China will have ripple effects. Everyone else in the global economy will certainly feel it. China is an important trade partner for many countries and cannot be easily replaced. 20% of US imports will be affected, 77% of Lithium-ion battery production is in China, the biggest importer of crude oil is China, and the list goes on.

According to South China Morning Post (https://www.scmp.com/economy/china-economy/article/3200123/chinas-covid-lockdowns-still-weigh-heavy-small-firms-despite-promise-more-bank-support), China’s Covid-19 lockdowns still weigh heavy on small firms, despite promise of more bank support. Chinese authorities have begun rolling out a raft of measures to help micro- and small-enterprises (MSE), including extending loan repaymentsBut that may not be enough for the country’s MSEs, who are struggling with revenue and cash flow due to wide-ranging coronavirus restrictions.

Finally, to achieve the 2035 GDP per-capita goal (reach the level of a medium-developed country), China needs to grow 4.7% each year for the next 13 years. How the Chinese government balances the common prosperity, economic growth, and national security should be closely watched.